Did you know that you can Apply Online and get the cash you need today?

Learning Center

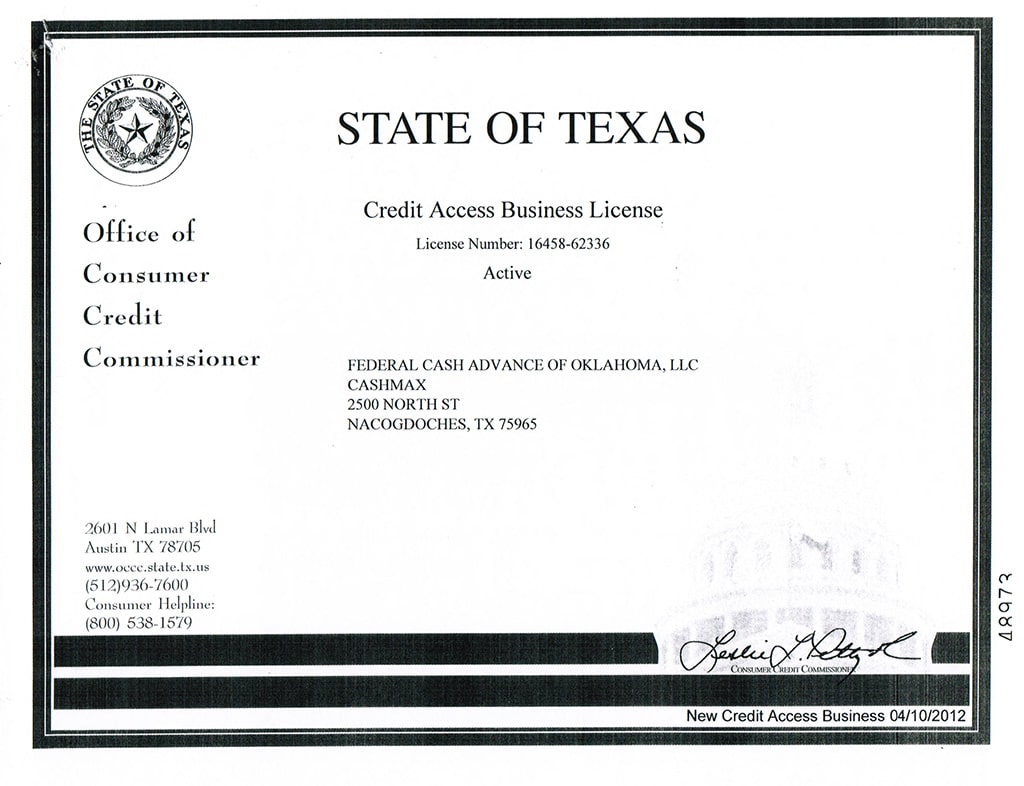

Welcome to the CashMax Learning Hub, your source for helpful information on managing your money. At CashMax, we aim to give you the knowledge and tools to make smart financial decisions. Whether you need tips on budgeting, saving money, or understanding payday loans, our easy-to-read articles are here to help. Start exploring and take control of your finances today!

Ways to Financial Relief – Prep Your Kids for a Healthy Financial Future this April

It’s incredibly important for kids to learn about finances early because understanding money management sets the foundation for responsible financial habits throughout life. When children grasp basic concepts like saving, budgeting, and the value of money at a young age, they are better prepared to make informed decisions as they grow older. By building financial

Ways to Financial Relief – Why wait until April to file your taxes?

Tax Day is quickly approaching. The IRS started accepting tax returns on January 27th, and by the April 15th federal deadline, the agency expects to receive more than 140 million individual tax returns. If you wait until the last minute, you will also be the last to receive your refund (should you be owed one).

Ways to Financial Relief – Setting Financial Resolutions

A new year often brings new resolutions for people in an effort to make their lives better. A resolution is a commitment, a reset, a roadmap, and overall, a chance to improve quality of life. The most effective resolutions need to be realistic. According to Bankrate’s 2024 money and mental health survey, over half

Ways to Financial Relief – 2024 Wrap Up

As we wrap up 2024, it’s a great time to ensure your finances are in strong shape for the new year and to make sure you are not missing out on anything in the current year. Year-End Financial Checklist Check In On Your Health: We often talk about financial health, but your physical & mental

Ways to Financial Relief – Don’t Fall for Seasonal Financial Surprises

As the leaves change and we transition into autumn, it’s a great time to review your financial goals for the remainder of the year. Here are some things you can do this October to be prepared for the end of 2024. Assess your progress, and make any necessary adjustments to your budget to stay on

Ways to Financial Relief – September is Self-Improvement Month

September, often recognized as Self-Improvement Month, provides the perfect opportunity to take stock of personal finances and implement changes that can lead to long-term financial security. This month-long focus on self-growth aligns well with financial goals, offering time to reflect on spending habits, savings strategies, and investment plans. By dedicating consistent time to assess and improve