Did you know that you can Apply Online and get the cash you need today?

Fee Schedules

Click a loan plan below to view more information on the different fee schedules we provide.

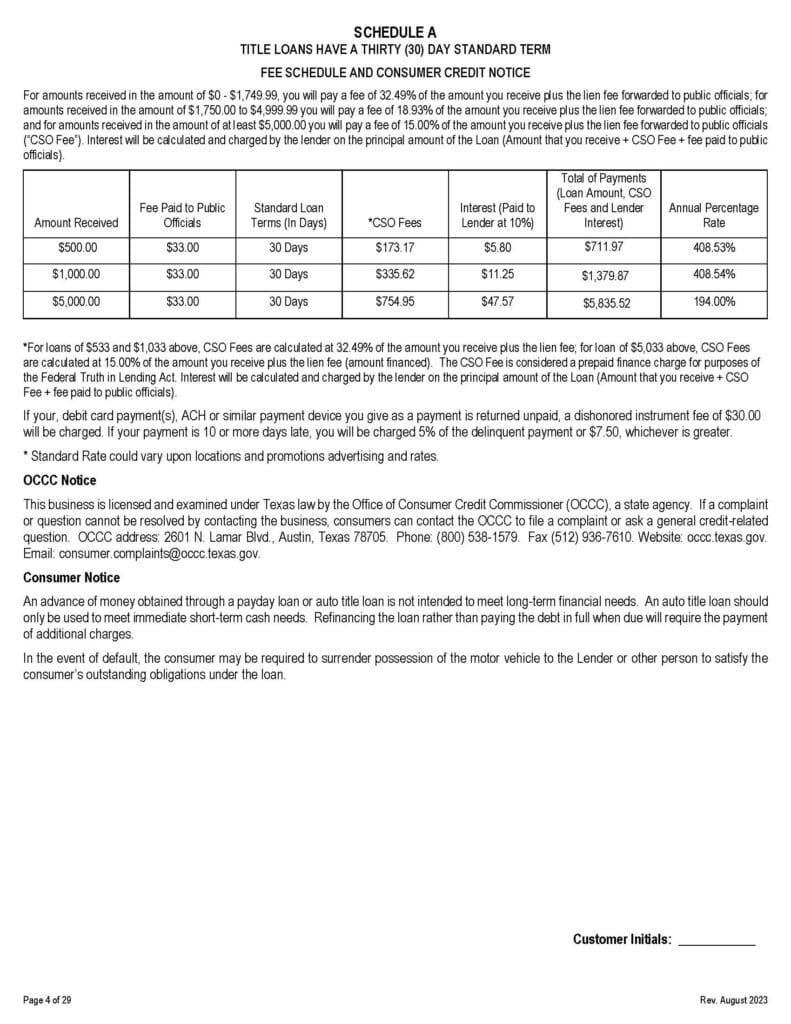

Single Payment Title Fee Schedule

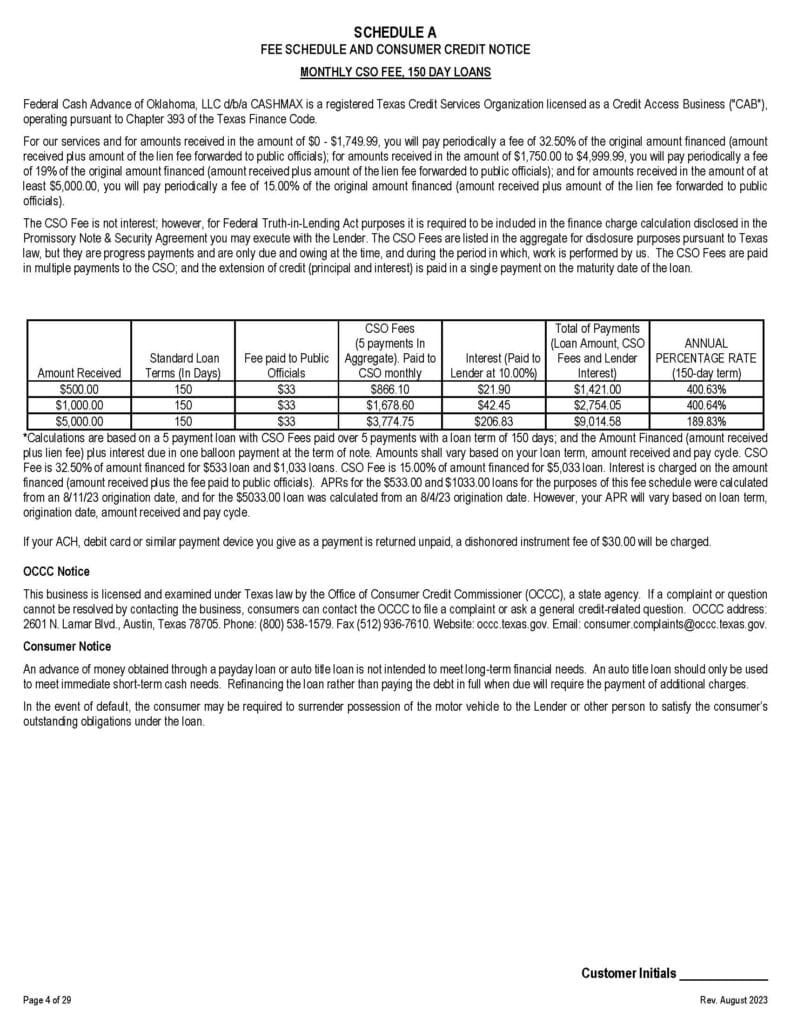

Multi Payment Title Fee Schedule

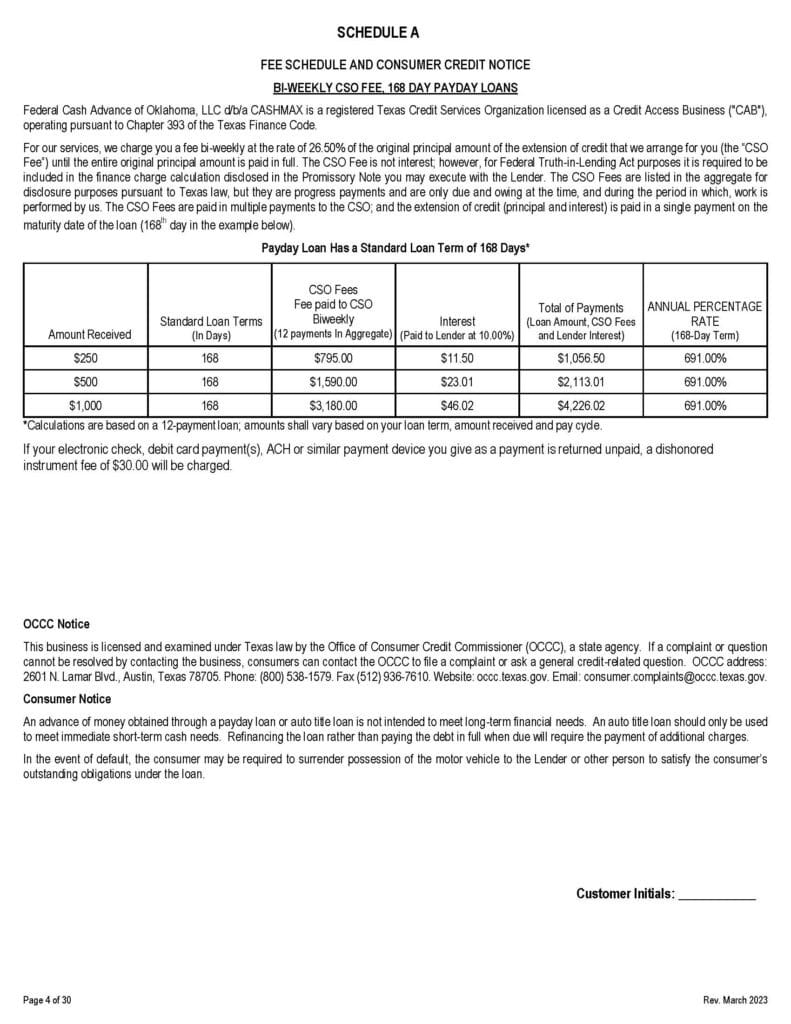

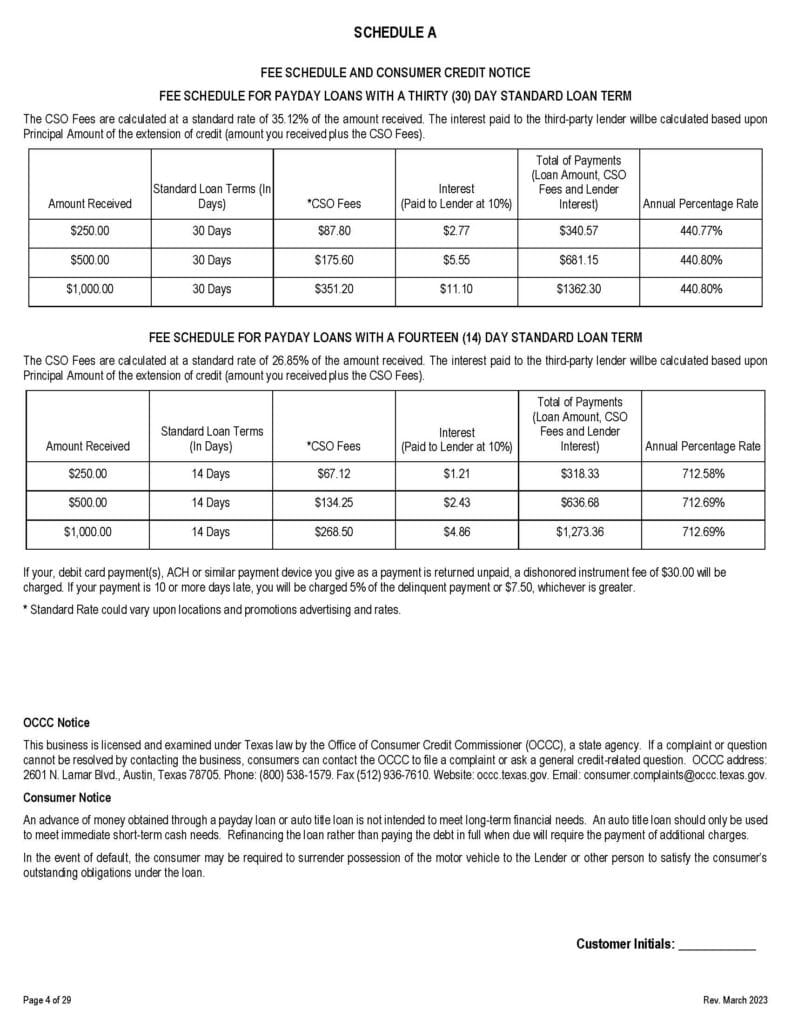

Single Payment Advance Fee Schedule

Multi Payment Advance Fee Schedule